-

Courses

Courses

Choosing a course is one of the most important decisions you'll ever make! View our courses and see what our students and lecturers have to say about the courses you are interested in at the links below.

-

University Life

University Life

Each year more than 4,000 choose University of Galway as their University of choice. Find out what life at University of Galway is all about here.

-

About University of Galway

About University of Galway

Since 1845, University of Galway has been sharing the highest quality teaching and research with Ireland and the world. Find out what makes our University so special – from our distinguished history to the latest news and campus developments.

-

Colleges & Schools

Colleges & Schools

University of Galway has earned international recognition as a research-led university with a commitment to top quality teaching across a range of key areas of expertise.

-

Research & Innovation

Research & Innovation

University of Galway’s vibrant research community take on some of the most pressing challenges of our times.

-

Business & Industry

Guiding Breakthrough Research at University of Galway

We explore and facilitate commercial opportunities for the research community at University of Galway, as well as facilitating industry partnership.

-

Alumni & Friends

Alumni & Friends

There are 128,000 University of Galway alumni worldwide. Stay connected to your alumni community! Join our social networks and update your details online.

-

Community Engagement

Community Engagement

At University of Galway, we believe that the best learning takes place when you apply what you learn in a real world context. That's why many of our courses include work placements or community projects.

Raising purchase orders

How do I get registered on the Financial System to become a web purchaser?

Please contact the Service Desk requesting Web Requisitioner access. You must also attach an email with authorisation from the Budget Holder.

Who is authorised to issue Purchase Orders and to certify invoices for payment?

The Budget Holder authorises the issuing of Purchase Orders and certifies invoices for payment. The Budget Holder may delegate these functions to staff within the department who have been formally entered on the University’s register of approved purchasers and whose limits in relation to that function have been noted.

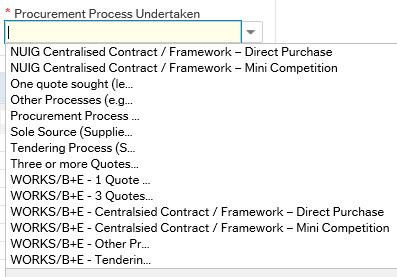

Where can I get a list of the "Procurement Process Undertaken" Options for my requisition?

Raising a requisition; Under the Procurement menu > Requisition Entry, there is a mandatory field in the form of a drop-down menu, where users must select the Procurement Process Undertaken for their requisition. Click here for assistance in choosing the appropriate procurement process for your requisition.

What is a Product Code?

Product Codes are used to categorise purchases by the University. A full list of Product Codes is available from the Procurement & Contracts Office.

To accurately report on University spending, it is essential that appropriate Product Codes are used on the purchase order to categorise what you are buying. A Product Codes is typically an abbreviation of the category of product or service, followed by a number, e.g. TRAVEL01, STAT01, etc. Each Product Codes is also a member of a product group which is linked to a four-digit general ledger number (e.g. 3170 Travel) that the Financial System will automatically assign to the product code you select. Typically this four-digit number starts with a 3* for non-capital spend. However, all equipment purchases valued in excess of €10,000 (inc VAT) is considered a capital purchase and must be registered as a University Fixed Asset for accounting purposes. Capital product codes that have a product group series starting with 4* must be used to record these capital assets. If you are buying equipment valued in excess of €10,000, please see the University's Fixed Asset Policy/Procedure.

Where can I get a list of Product Codes, General Ledger and Sub-Account Codes?

A full list of Product Codes is available from the Procurement & Contracts Office.

Where can I get information about generating Purchase Orders?

Purchase Orders are generated through the Financial System web-based purchasing portal, which is intended for use by staff familiar with the purchasing procedures at NUI Galway. For detailed instructions see Getting Started, "How To" documentation and our FAQ's

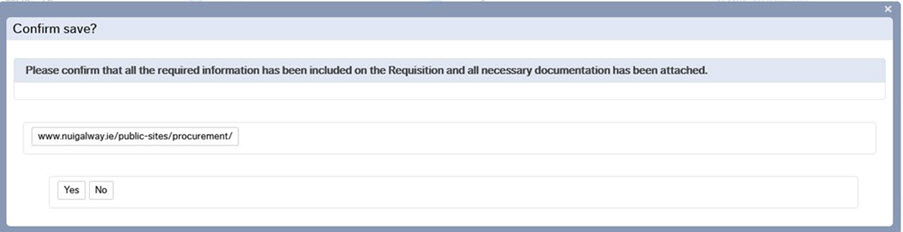

What do I need to confirm Procurement Compliancy Requirements have been met on my requisition >€5k?

Requisitions greater than €5000 will generate an on-screen pop-up message asking users to confirm procurement compliancy requirements have been met. It is a mandatory requirement that requisitions greater than €5000 should have one or more documents uploaded to the requisition with the relevant procurement-related documentation. Click here for guidance on what documentation is required for each procurement process.

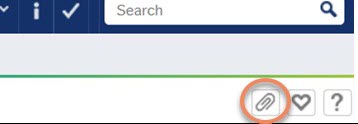

How do I upload/attach one or more documents to my requisition?

It is a mandatory requirement that requisitions greater than €5000 should have one or more documents uploaded to the requisition with the relevant procurement-related documentation. Click here for guidance on what documentation is required for each procurement process.

- To attach one or more documents (previously saved on your PC) to a requisition, please click on the paperclip icon on the top right-hand corner of the screen.

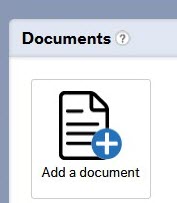

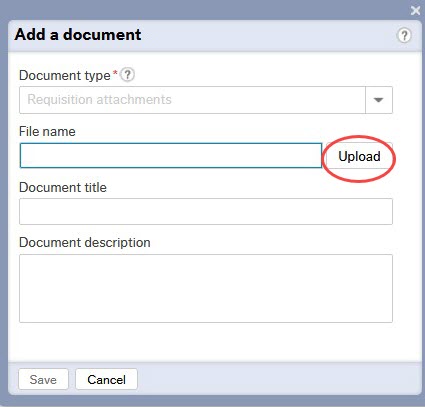

- This will bring up a pop-up window titled Documents. Click on the Add a Document box.

- Click the Upload button.

- Browse to the document, click it and then hit Save. Note the limit is 3MB.

- Repeat for each document you wish to add then close the Add a Document box.

When should I generate a Purchase Order?

It is University policy to generate a Financial System Purchase Order (PO) for all purchases, with the exception of regular deliveries of Tipperary Water, Club Travel and Catering bookings. The University has implemented the facility to have all Purchase Orders raised by way of a 'web requisition' which, assuming budget availability, generates a PO for sending to the supplier. Our procurement policy states that all procurements must be initiated by the PO process.

How long does it take before the Purchase Order (PO) is emailed to me?

This depends on whether it needs to be approved by someone else or not. If it is under your approval limit (either €500 or €10,000), you should receive an email containing the PO within one hour of generating the requisition. If it needs to be approved by someone else, you should receive an email within one hour of approval.

What do I do if I haven't received a Purchase Order?

POs are sent out once an hour so make sure that you have not entered your requisition within the last hour. Check the status in Requisition Status. If your requisition has a status of Finished and you have entered it hours ago and still have not received it, then contact the Service Desk, who will re-send it to you.

I requested a purchase order more than an hour ago and have not received anything by e-mail. What should I do?

Log a ticket with the Service Desk quoting the requisition number. ISS will be able to tell you why the purchase order has not been generated.

I’ve got an email telling me that the item has been parked. Why is this?

Items usually get parked for one of three reasons:

- There is not enough money in the account to purchase the item.

- The approver has parked it for some reason.

- There is a technical problem with the Financial System.

Is it possible to unpark a parked requisition?

You will find information on how to unpark a requisition here.

How will I find out why an item has been parked?

Log a ticket with the Service Desk, quoting the requisition number.

Can I modify/edit/reuse and existing requisition?

Yes, you can modify/edit/reuse an existing requisition as long as it has not been approved and PO created.

How do I close/cancel a Requisition?

- If the requisition is rejected then click the rejected requisition task to load the requisition.

- Change each requisition line items status to Closed.

- Change the requisition status to Closed.

- Click save.

How do I cancel a Purchase Order?

Contact Accounts Payable with the order number and request to cancel it for you. This will release the funds that were committed to that order.

How do I reject a requisition that came to me in error?

Go to Requisition Approval and click on the requisition that is waiting to be approved. Tick the check box to the left of the line and enter a comment in the Comment Box, e.g., Rejected by XXXX. Tick on the Reject icon and save it. This will then be returned to the requisitioner who raised it.

What does 'requisition not distributed' mean?

This means that you are not authorised to raise web requisitions from this Cost Center. You may have access to it in the Financial System but not on the web portal. You need to ask Orla Timon, Research Accounting (for research and capital Cost Centre), or Nicola McNicholas, Management Accounting (for departmental Cost Centre), to authorise the setup of the Cost Centre in question for web requisitioning. Please note that requisitions cannot be deleted.

Why do certain Product Codes not allow me to enter a quantity of more than one?

Some products are set up to allow you to input a quantity of one only, for example, services.

What approvals are required for purchase orders and invoices of varying values?

Approval for prequisitions and einvoices is determined by the amount involved, click here for more information.

The Procurement Policy is available to view in the Financial & Accounting Group of the University's central Policy & Procedures repository.

What are the different VAT rates that apply in Ireland?

The standard rate of VAT is 23%. This means that most goods and services in Ireland are liable to 23% VAT.

There is also a rate of 13.5%, referred to as the reduced rate, and a zero% rate. These lower rates cover a mix of goods and services and cannot be easily categorised. However, it is worth noting that the 13.5% rate applies to a number of labour-intensive services, and the zero% rate applies to many foods and medicines, and to children’s clothes.

A second reduced VAT rate of 9% applies to certain goods and services previously liable at the 13.5% rate, including restaurant and catering services; hotel and holiday accommodation; admissions to cinemas, theatres, certain musical performances, museums and art gallery exhibitions; fairgrounds or amusement park services; the use of sporting facilities; hairdressing services; printed matter such as brochures, maps, programmes, leaflets, catalogues and newspapers.

Where can I get information on VAT rates for goods or services from suppliers outside Ireland?

Please see information at this link for VAT rates for goods or services from suppliers outside Ireland.