-

Courses

Courses

Choosing a course is one of the most important decisions you'll ever make! View our courses and see what our students and lecturers have to say about the courses you are interested in at the links below.

-

University Life

University Life

Each year more than 4,000 choose University of Galway as their University of choice. Find out what life at University of Galway is all about here.

-

About University of Galway

About University of Galway

Since 1845, University of Galway has been sharing the highest quality teaching and research with Ireland and the world. Find out what makes our University so special – from our distinguished history to the latest news and campus developments.

-

Colleges & Schools

Colleges & Schools

University of Galway has earned international recognition as a research-led university with a commitment to top quality teaching across a range of key areas of expertise.

-

Research & Innovation

Research & Innovation

University of Galway’s vibrant research community take on some of the most pressing challenges of our times.

-

Business & Industry

Guiding Breakthrough Research at University of Galway

We explore and facilitate commercial opportunities for the research community at University of Galway, as well as facilitating industry partnership.

-

Alumni & Friends

Alumni & Friends

There are 128,000 University of Galway alumni worldwide. Stay connected to your alumni community! Join our social networks and update your details online.

-

Community Engagement

Community Engagement

At University of Galway, we believe that the best learning takes place when you apply what you learn in a real world context. That's why many of our courses include work placements or community projects.

Payments and Suppliers

How do I know what supplier(s) I use to buy a particular product or service?

First, check if there is a centralised contract in place for the category of product. All centralised contracts are listed here.

If there is not a contract in place, then the process you need to follow will depend on the value of the spend. Please see the Step by Step guide at this link.

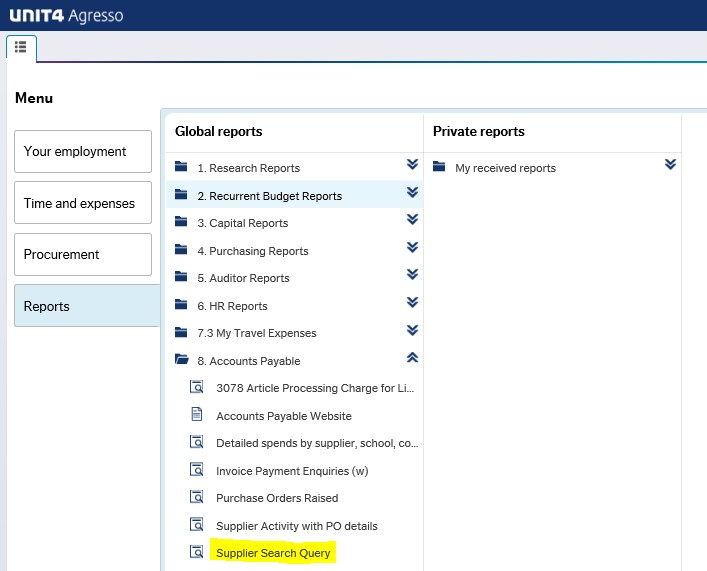

How do I check if a supplier is set up on the Financial System?

On the Financial System requisition screen, click into the "Supplier" field and start typing the name of the supplier - details of supplier names matching what you have typed will start to appear. For an advanced search, click on the blue box to the right of the Supplier" field. This brings you into a search screen. Here, you can enter either full or part of the company name or address.

If it is your first time ordering from a supplier, they may not be set up on the Financial System. If the supplier is not set up, then you cannot create a purchase order. Details on the Supplier Setup Process are available at this link.

What tax clearance stipulations are placed on suppliers?

If purchases from a supplier are of a value of €10,000 or more in a 12-month period, they must furnish us with an Irish Revenue Tax Clearance Certificate, even if they are based overseas.

Details are available on http://www.revenue.ie/en/online/tax-clearance.html

To properly complete the new supplier set-up form should only take a few moments but the procurement of a Tax Clearance Certificate (if the new supplier does not already have one) may take two to three weeks.

When are payments made to suppliers?

NUI Galway pays its suppliers by EFT (electronic funds transfer) directly into supplier bank accounts fortnightly. Further information is available here.

What procedure must be followed to ensure timely payment of invoices?

There are two principal methods by which you can ensure speedy payment for your purchases and both require you to take time to respond to deliveries of goods/services or invoices:

a) On satisfactory receipt of goods/services you have ordered by way of web ordering, log on to the Financial System system and create a goods received note (GRN) for the items received (i.e., confirm satisfactory receipt which is tantamount to authorising payment).

b) If the web GRN process cannot be used (e.g., because the procurement was not initiated via web requisitioning), the supplier invoice will be sent to you in the internal mail by the Accounts Payable Office. You should cross-check the details per the supplier invoice with the delivery docket or goods received note and, if satisfied, code and authorise the invoice for payment before returning it to Accounts Payable. The supplier will not be paid unless you return the invoice.

What are late payment costs?

NUI Galway must pay for the goods and services that it procures within 30 days of the invoice date unless there are other payment terms expressly agreed, or unless there is an issue with invoice payment (due, for example, to work not completed to specified standard). Apart from these two exceptions, if payments are made outside of the agreed payment terms (30 days), under the Late Payments in Commercial Transactions Regulations 2012, suppliers are entitled to claim:

- interest for late payments, and

- compensation for remaining reasonable recovery costs.

These costs are additional costs to a budget holder’s cost centre - they represent added costs of procuring and purchasing goods and services from the supplier. There is no discretion.

For further information on late payment costs and on the current interest rates and compensation values, click on the Department of Jobs, Enterprise and Innovation website.

So what should I (as Budget Holder) do to ensure that no late payments costs are processed to my budget?

Where there is no dispute with an invoice, please ensure it is approved, coded and sent to the Accounts Payable team well within the agreed payment terms of the contract.

Ensure that enough time is allowed for the Accounts Payable team to process and pay the invoice. The Accounts Payable team can inform you of payment run schedules, on request.

Where there is an issue with an invoice, please contact the supplier immediately to resolve it (e.g., ask for a credit note to be issued until the matter is satisfactorily dealt with, etc.)

Where do I go if I want more details on late payment costs (e.g. the interest rate or compensation values)?

The Department of Jobs, Enterprise and Innovation have an excellent FAQ section on this topic that deals with relevant matters, including current interest rates and compensation values.

What do late payment costs mean for me, as Budget Holder?

Unless there is a specific issue with paying an invoice (e.g. work hasn’t been done to a professional standard), the supplier will be entitled to interest and compensation as laid out in the Late Payments in Commercial Transactions Regulations 2012.

These costs are additional costs to a Budget Holder's cost centre. There is no discretion (as the costs are legislated for) and will essentially be another cost of procuring and purchasing goods and services from the supplier.

I have received an invoice from another University department for services provided. How do I deal with it?

Sign the invoice, code it correctly and forward it to the Accounts Office. The invoice will be dealt with by way of an internal transfer.

I need to get a supplier setup on Financial System - what do I have to do?

When the need arises to set up a new supplier on Financial System, the New Supplier Setup Form must be completed as follows:

Part A: Supplier Details - please issue the form to the supplier for completion

Part B: Budget Holder - the Budget Holder/Requestor must complete this section

Once Parts A and B are completed in full, the form must be sent to the Procurement & Contracts Office for review. If approved, the Procurement & Contracts Office will sign the form and forward it to Accounts Payable for co-signing. Once the form has been signed by both Procurement and Accounts Payable, the supplier will then be set up on the Financial System.

Further information on the Supplier Setup Process and access to the Supplier Setup Form can be found at this link.