-

Courses

Courses

Choosing a course is one of the most important decisions you'll ever make! View our courses and see what our students and lecturers have to say about the courses you are interested in at the links below.

-

University Life

University Life

Each year more than 4,000 choose University of Galway as their University of choice. Find out what life at University of Galway is all about here.

-

About University of Galway

About University of Galway

Since 1845, University of Galway has been sharing the highest quality teaching and research with Ireland and the world. Find out what makes our University so special – from our distinguished history to the latest news and campus developments.

-

Colleges & Schools

Colleges & Schools

University of Galway has earned international recognition as a research-led university with a commitment to top quality teaching across a range of key areas of expertise.

-

Research & Innovation

Research & Innovation

University of Galway’s vibrant research community take on some of the most pressing challenges of our times.

-

Business & Industry

Guiding Breakthrough Research at University of Galway

We explore and facilitate commercial opportunities for the research community at University of Galway, as well as facilitating industry partnership.

-

Alumni & Friends

Alumni & Friends

There are 128,000 University of Galway alumni worldwide. Stay connected to your alumni community! Join our social networks and update your details online.

-

Community Engagement

Community Engagement

At University of Galway, we believe that the best learning takes place when you apply what you learn in a real world context. That's why many of our courses include work placements or community projects.

Procurement and Purchasing

Where can I get Procurement Training?

The Procurement Office provides Procurement Foundation Training online click here for more details.

Note: To access the Procurement Office website from off-campus locations, please see the following details online.

Where can I get a list of the Procurement Process Options for my requisition?

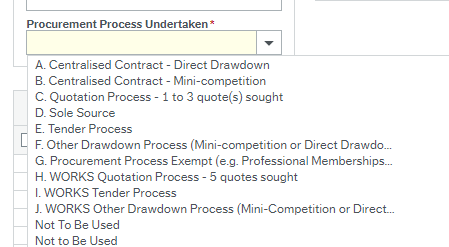

Raising a requisition; Under the Procurement menu > Requisition Entry, there is a mandatory field in the form of a drop-down menu, where users must select the Procurement Process Undertaken for their requisition. Click the Procurement Office website for assistance in choosing the appropriate procurement process for your requisition.

Note: To access the Procurement Office website from off-campus locations, please see the following details online.

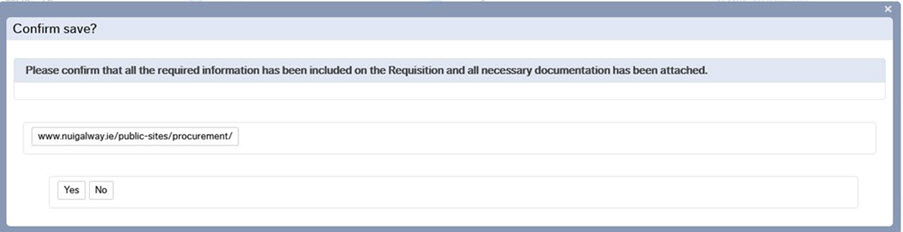

Requisitions greater than €5000 will generate an onscreen pop-up message

It is a mandatory requirement that requisitions greater than €5000 should have one or more documents uploaded to the requisition with the relevant procurement-related documentation.

Click here for guidance on what documentation is required for each procurement process.

Requisitions without evidence of a proper procurement process and or the appropriate documentation attached will be rejected.

What is the size limit for attaching documents to my requisition?

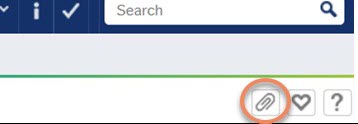

- To attach one or more documents (previously saved on your PC) to a requisition, please click on the paperclip icon on the top right hand corner of the screen.

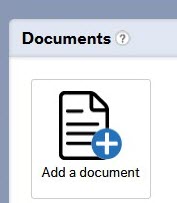

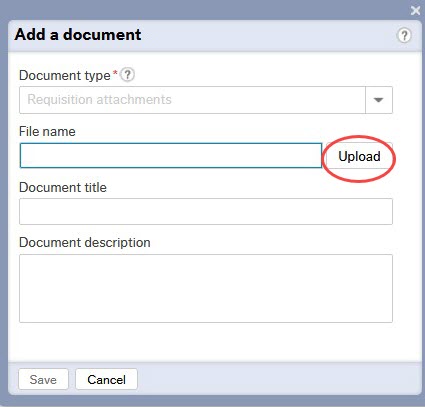

- This will bring up a pop up window titled Documents. Click on the Add a Document box.

- Click the Upload button.

- Browse to the document, click it and then hit Save. Note the limit is 3MB.

- Repeat for each document you wish to add then close the Add a Document box.

What are the tendering thresholds?

The current tendering thresholds are as follows:

All Supplies & Services > €50,000* < €215,000 National Tender. *where the estimated contract value is witin a 10% margin e.g. €45,000 (ex VAT), a tendering process should be initiated)

All Works > €200,000 < €5,382,000 National Tender

All Supplies & Services > €215,000 EU Tender.

All Works > €5,382,000 EU Tender

These thresholds are in line with Government Policy. Staff will be notified on revision of these thresholds.

Requirements for all spend limits are detailed in the Procurement Policy.

For more information please visit the website of the Procurement & Contracts Office.

How many quotations do I need to buy a product or service?

The number of quotations required is determined by the spend value over the life of the contract:

Goods and Services Thresholds:

- All Goods & Services < €5,000 (ex VAT): seek min 1 written quotation from a genuine participant applicable to the requirement, and short written explanation on how value for money has been achieved

- All Goods & Services > €5,000 < €50,000* (ex VAT) – seek min 3 written quotations from genuine participants that are applicable to the requirements. Quotations will be sought in response to a brief specification, and short written explanation on how value for money has been achieved.

*where the estimated contract value is witin a 10% margin e.g. €45,000 (ex VAT), a tendering process should be initiated) - All Goods & Services > €50,000* or within the 10% margin (ex VAT) requires a tendering process.

Works Contracts Only:

- All Works Related < €200,000* (ex VAT): seek min 5 written quotations from genuine participants that are applicable to the requirements. *or within a 10% margin e.g. €180,000

- All Works > €200,000 (ex VAT) requires a tendering process.

A series of limits are detailed in the Procurement Policy.

Full details of the Quotation Process are available at this link.

I have funding to buy a piece of equipment and have been told I need to tender.

What do I have to do to begin the tendering process?

Contact the Procurement & Contracts Office (procure@universityofgalway.ie) in the first instance.

A step by step guide is available here.

Information on each stage of the tender process is available on the Procurement & Contracts Office website. There are two types of processes, depending on the value of the spend:

All Supplies & Services > €50,000* < €215,000 National Tender. *where the estimated contract value is witin a 10% margin e.g. €45,000 (ex VAT), a tendering process should be initiated)

All Works > €200,000 < €5,382,000 National Tender

All Supplies & Services > €215,000 EU Tender.

All Works > €5,382,000 EU Tender

Please note the timeline for the intiation of a tender process is approximately 4-6 months. Early contact with the Procurement & Contracts Office is essential.

For more information on Procurement & Contracts please click here.

As far as I know there is only one manufacturer/service provider for the product/service I need, but the policy says I need three quotations. What do I do?

Where it has been established that there is only one supplier who can provide you with the product/service, this is deemed to be a Sole Source. The Sole Source process, which must only be used in rare and exceptional circumstances, allows for the purchase to be made without running a competitive quotation or tender and must therefore be justified. The burden of proof to justify sole source procurement falls to the Budget Holder. Documentary evidence supporting the justification for Sole Source must be submitted to support your application e.g. letter from the manufacturer confirming single distributor, or letter from developer of prototype device, etc.

Full details on the Sole Source Process can be found at this link.

The Sole Source approval from the Procurement & Contracts Office must be obtained in advance of making the buying decision.

What is a centralised contract?

A centralised contract is the result of an aggregation of spend for goods or services commonly used by Schools or Units, that have been tendered on the open market. In line with Government Policy, there is an obligation on the University and its staff to use the suppliers that are awarded centralised contracts.

For more information on Procurement & Contracts please click here.

What if I want to buy an item that is not among the category of products/services covered in the centralised contract?

If there are suppliers contracted to the University who supply such products, then these should be consulted in the first instance. If it is not possible to purchase the item from these suppliers, then quotations will need to be sought. The number of quotations required will depend on the value of the spend. Requirements for the spend limits is detailed in the Step by Step Guide.

What are APT2 forms and where can I get one?

APT2 forms are used when purchasing alcohol or methylated spirits.

To request an APT2 form please email accountspayable@universityofgalway.ie or phone ext 2120 or 3278.

The University has a licence which allows us to purchase pure or absolute alcohol and industrial methylated spirits for research and teaching purposes duty free.

In order to purchase these materials duty free departments must -

- Request an APT2 for Accounts Payable

- Complete the APT2 for with the following information -

- amount of alcohol being purchased;

- type of alcohol e.g. ethanol or Industrial Methylated spirits.

- Send purchase order and completed APT2 form to the supplier.

- Once the product is delivered, complete the required information on the attached APT2 form and file as APT2 forms must be readily available for inspection by Revenue Commissioners at all times.

- Full records of all duty free alcohol use must be maintained in a log book ensuring full records of the amount of alcohol or spirits held on premises are kept.

- All alcohol stored should tally with the log book as this may be audited by Revenue Inspectors.

- Stocks of duty free alcohol must be stored in a locked facility and access to this storage facility must be restricted.

All records regarding the use of alcohol products purchased duty free are subject to inspection by Revenue Commissioners – including the records of usage and all APT2 form.

All such records must be kept and readily available on the premises where the alcohol is stored.

How does the new Government Policy change how we buy, in relation to Procurement?

Where it has been identified that a tender process is required, the Office of Government Procurement (OGP) must be consulted in the first instance.

The OGP will review the requirement and will then:

(a) identify a suitable public sector contract that can be availed of

(b) appoint a sourcing partner who will tender on behalf of NUI Galway or

(c) give authorisation for NUI Galway to tender directly for its requirements.

The Procurement & Contracts Office will liaise with the Office of Government Procurement on behalf of the budget holder.

If you are planning a purchase that exceeds €25,000, you must allow a minimum of 4 months to initiate a tender process. Therefore, please contact the Procurement & Contracts Office as soon as possible by email to procure@universityofgalway.ie or on ext 3970.

What are the Financial System VAT codes?

Vat Codes Explained

|

|

13.5% |

13.5% |

23.0% |

23.0% |

|

|

Non Reclaimable VAT |

Reclaimable VAT |

Non Reclaimable VAT |

Reclaimable VAT |

|

VAT on Purchases (Goods & Services in Ireland) |

P1 |

P3 |

P2 |

P4 |

|

VAT on Purchases of Goods from other EU Countries |

U1 |

U3 |

U2 |

U4 |

|

VAT on Purchases of Goods from NON EU countries |

I1 |

I3 |

I2 |

I4 |

|

VAT on Purchases of Services outside of Ireland |

F1 |

F3 |

F2 |

F4 |

**** For PSWT and Construction Services, please refer to Financial Accounting Website.